After Extreme Walmart Volatility, Bitcoin Nears $46K: DOT Spi

The past 24 hours were highly volatile for bitcoin and the alternative coins. BTC saw a few multi-thousand dollar moves in both directions before calming around $46,000. On the other hand, Polkadot and Solana have charted impressive gains.

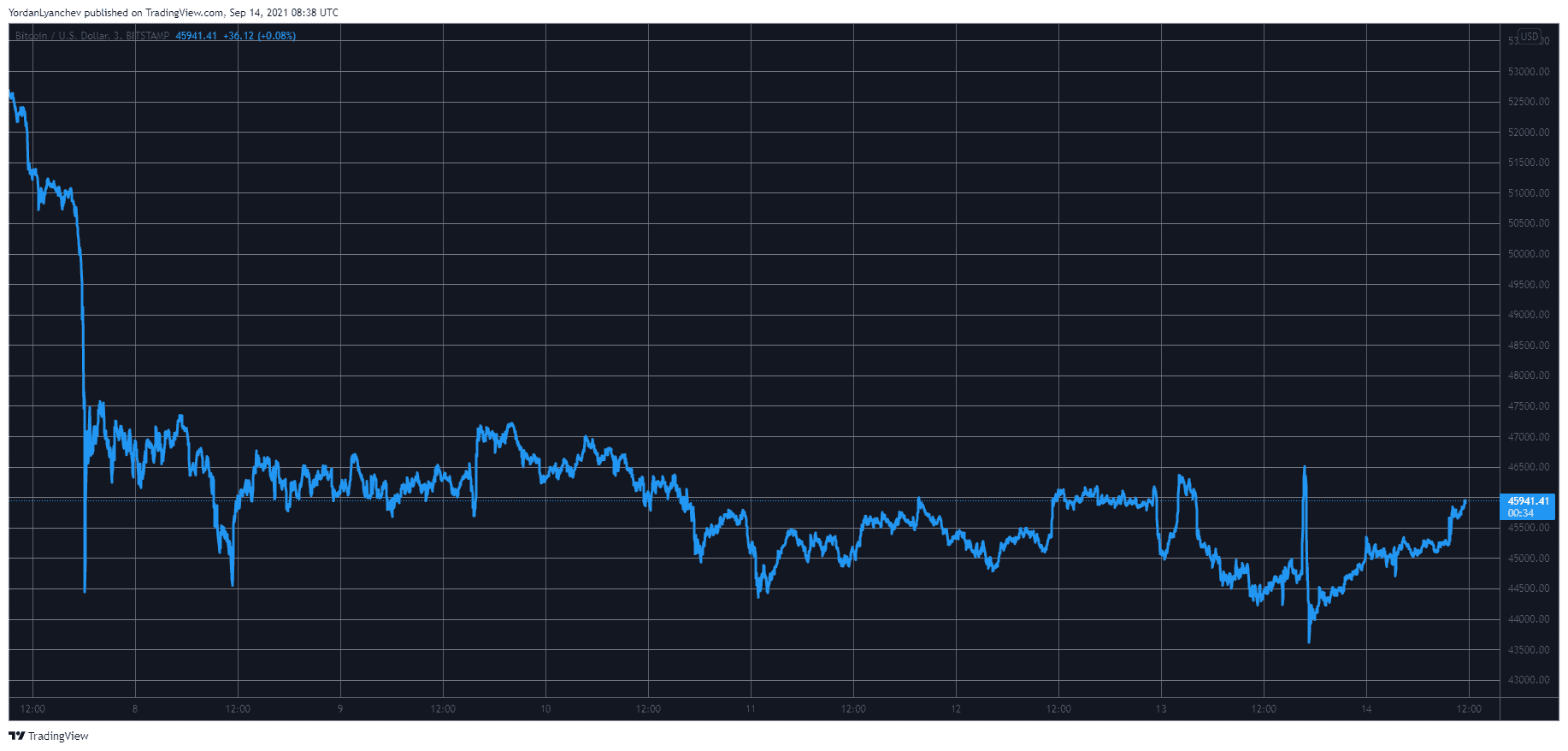

Bitcoin’s Wild 24H Ride

The primary cryptocurrency struggled in the past week as it dropped by $10,000 on September 7th to a multi-day low of $43,000. It attempted a quick recovery but was rejected on numerous occasions at around $47,000.

As such, it had settled below that level where it traded for a while. Yesterday, though, the situation changed when reports came claiming that Walmart has partnered with Litecoin to allow its customers to make purchases via the asset.

The markets reacted immediately, with BTC surging from $44,500 to a daily high of just under $47,000. However, the news turned out to be fake, and bitcoin headed south rapidly. Just minutes later, the cryptocurrency had lost more than $3,000 of value and bottomed at $43,400 (on Bitstamp).

Since then, bitcoin has reclaimed a lot of ground. It bounced off above $45,000 in hours and has increased to just shy of $46,000 as of writing these lines.

Its market capitalization has risen to over $850 billion while the dominance over the alts sits tight at 41.5%.

Alts See Green; DOT Surges 9%

The alternative coins mimicked BTC’s performance yesterday. Ethereum went from $3,200 to $3,400 and dumped all the way down to $3,100. Now, ETH has added roughly $200 of value and stands above $3,300.

On a 24-hour scale, Cardano, Binance Coin, Ripple, and Terra are up by a similar percentage (around 3%). Litecoin, the main player of yesterday’s story, is also up daily by 4.5% as it trades at $180.

Avalanche, Solana, and Polkadot are the best performers from the larger-cap altcoins. AVAX has increased by 7%, SOL by 8%, and DOT by more than 9%.

Further gains come from Celo (25%), Synthetix (25%), Mina (24%), Hedera Hashgraph (22%), Perpetual Protocol (21%), ICON (20%), Cosmos (16%), Telcoin (15%), and Tezos (15%).

The cumulative market cap of all crypto assets, which pumped and dumped by billions yesterday, is now up to nearly $2.1 trillion.