Bitcoin Drops Below $45K, Crypto Market Cap Slumps $120B (Wee

After a few days of consolidation around $46,000, bitcoin has headed south and dropped beneath $45,000. Most altcoins have retraced in a similar fashion, with a few exceptions. LUNA is among those as it pumped by double-digits to tap a new ATH above $40.

Bitcoin Slides Below $45K

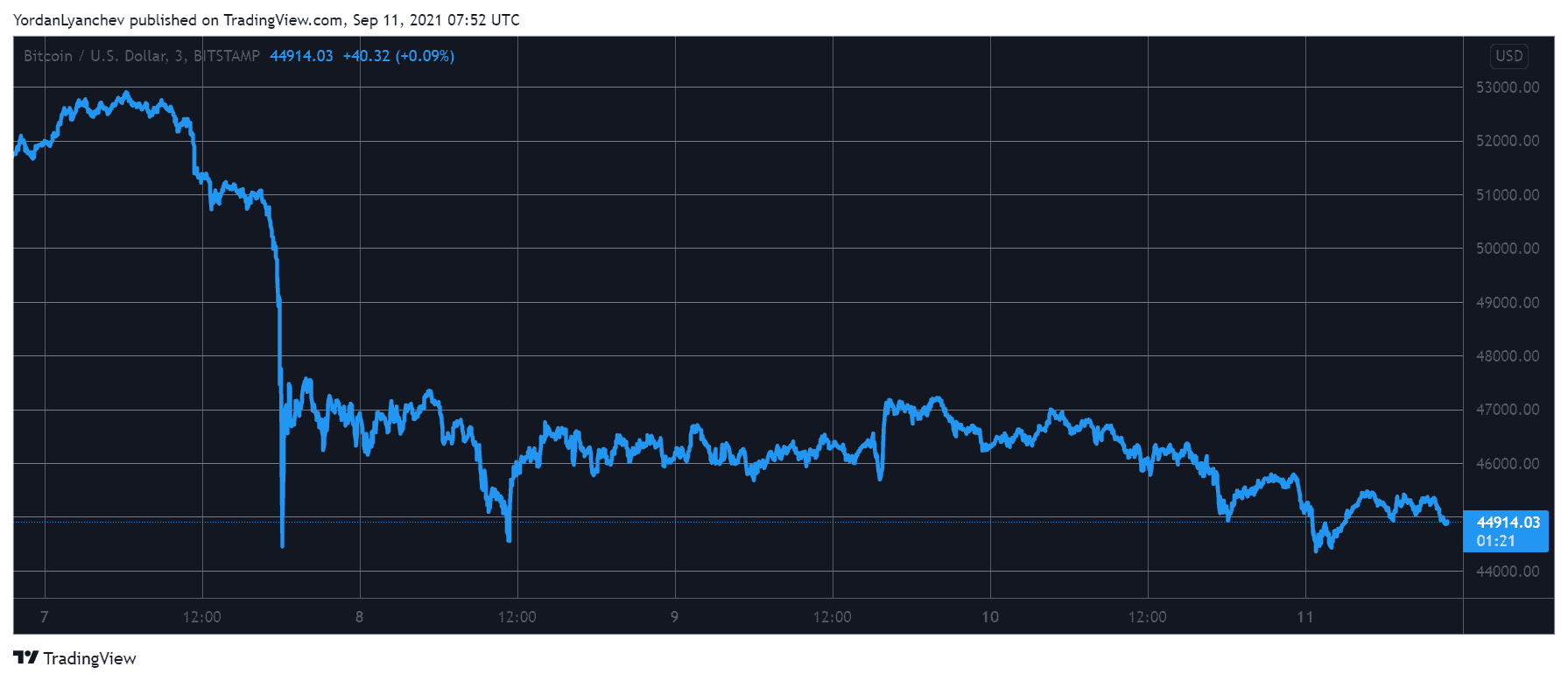

The primary cryptocurrency had a rough week. As it was preparing to become a legal tender in El Salvador, its price went to a multi-month high at just over $53,000. However, shortly after it became official, BTC plummeted in value.

In just a matter of hours, it lost over $10,000 and bottomed at $43,000. It bounced off somewhat rapidly to $46,000 and even challenged $47,000 a day later, but it ultimately failed to continue higher.

Just the opposite, the bears pushed it south once more in the past 24 hours, and it dipped to just over $44,000. As of now, it has recovered several thousand dollars but still struggles below $45,000.

Bitcoin’s market capitalization is down beneath $850 billion, and its dominance over the altcoins has remained still at 41.5%.

Altcoins Drop Again; LUNA Goes For an ATH

Most alternative coins have mimicked their leader’s performance lately. After the mid-week market crash, Ethereum dropped to around $3,000. It bounced off and went above $3,500, but another price dip has driven it to approximately $3,250.

Cardano (-4%) has declined beneath $2.4. Binance Coin, which went above $500 just days ago, now struggles to remain above $400. Solana – one of the best performers lately – has lost 5% in a day and now stands at $175.

Ripple (-4%), Dogecoin (-5%), Polkadot (-7.5%), Chainlink (-6.5%), and Bitcoin Cash (-5%) are also well in the red.

In contrast, Terra has surged by more than 25% in a day. As a result, LUNA charted a fresh all-time high just a few hours ago at above $40.

Quant (27%), Elrond (22%), Avalanche (17%), and Raydium (10%) have also marked impressive gains in a day to contrast with the rest of the market. Nevertheless, most lower- and mid-cap alts are in red.

Double-digit losses are evident from Celo, IOTA, Revain, eCash, Arweave, Perpetual Protocol, and more. As such, the cumulative market cap of all cryptocurrency assets has lost more than $120 billion in a day and is just over $2 trillion now.