Cardano’s Social Engagement Surpassed Bitcoin as ADA Broke ATH Nearing $3

With Cardano’s price skyrocketing to new all-time highs, the asset has garnered the attention of the cryptocurrency crowd. On-chain data from social media platforms confirmed that ADA had become the most talked-about digital asset in the past few days.

ADA Takes Over Twitter

It’s safe to say that Cardano’s native cryptocurrency has been on a roll since the start of the year. Looking at a more micro-scale, meaning in the past month, ADA has blown out of the water most of its competitors.

Back on July 20th, when the entire market corrected, it dumped below $1. This came after exploding by more than 1,200% in the first few months of 2021.

After the massive retracement, though, ADA started to return to its glory days rapidly. It doubled in value in a few weeks, kept climbing, and broke above its previous ATH just recently, as reported.

However, it didn’t stop there and continued north. Just hours ago came the latest record at $2.95 (on Bitstamp). Being 194% up since July 20th and more than 1,500% up YTD has, somewhat expectedly, caught the attention of the community.

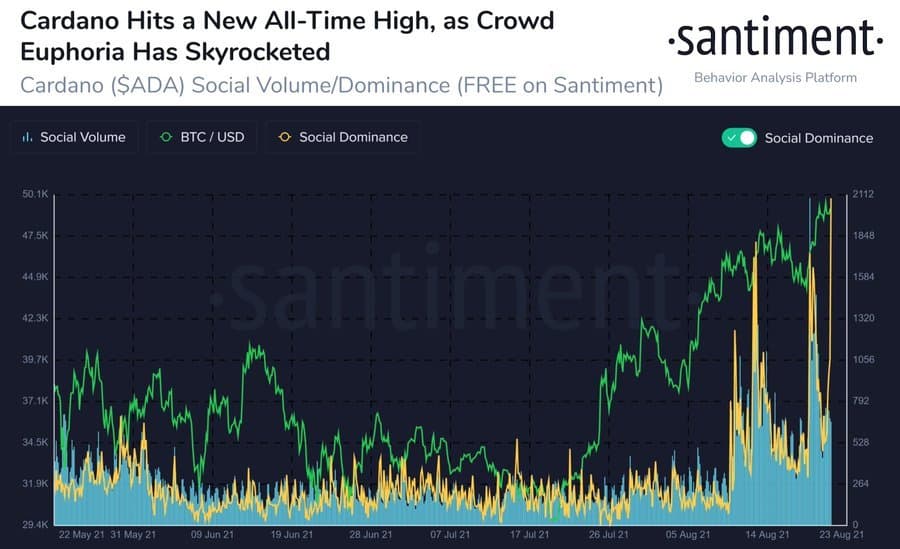

Santiment reported that the number of mentions of the Cardano and ADA hashtags went through the roof on Twitter during the weekend. The analytics company indicated that this growing engagement “will have a major hand in whether prices continue towards $3 and beyond.”

Santiment later updated that the number of Twitter mentions even surpassed those of bitcoin, even though the primary digital asset spiked above $50,000 for the first time since May.

Room for More Attention?

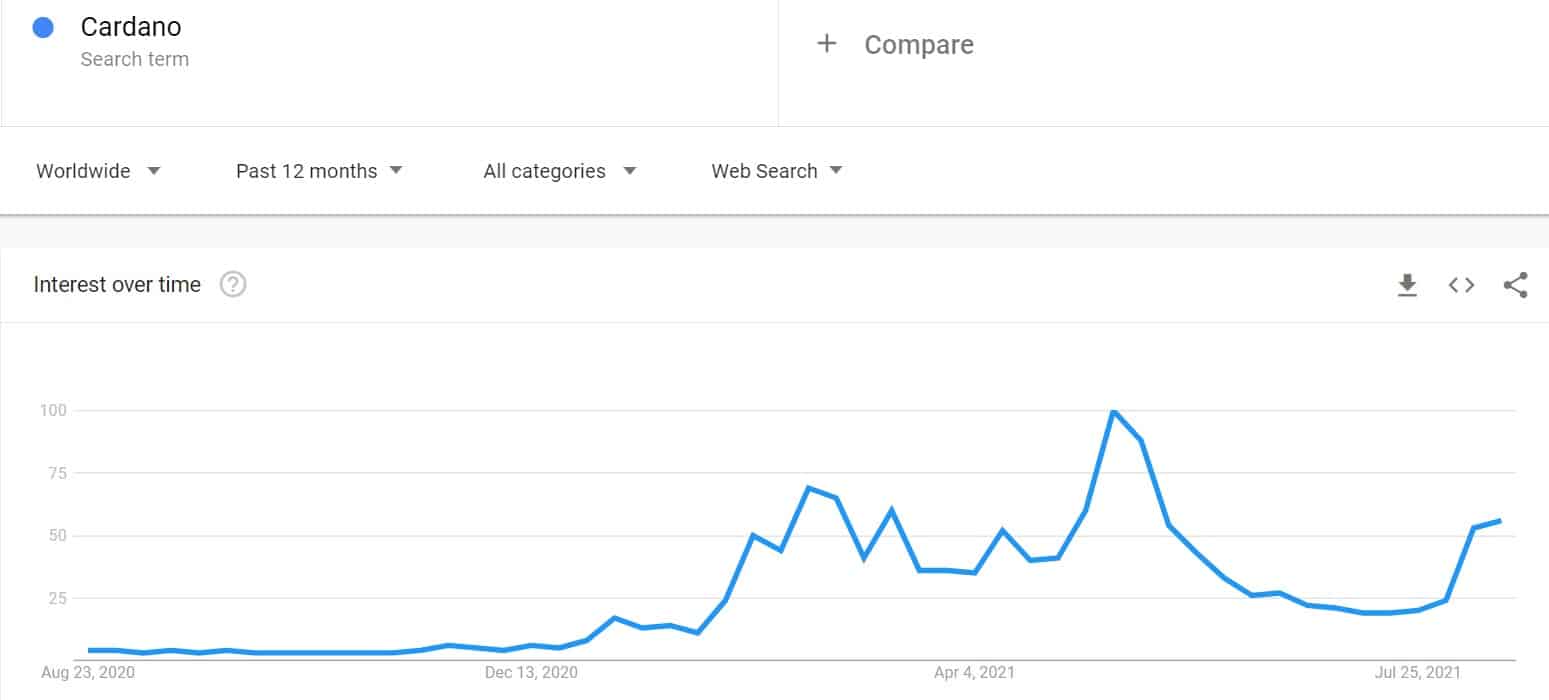

While the short-term Twitter engagements exploded over the weekend, Google trends data shows that there could be more attention coming.

The number of Cardano (or ADA) queries on the world’s largest search engine have definitely picked up lately, as the graph below demonstrates. However, they are still far away from the May peak when ADA reached its ATH at that time.

Since Google trends is typically a good indicator for retail investors’ behavior, it’s safe to assume that they haven’t arrived fully yet. Keeping that in mind, ADA’s price could indeed aim higher if the previous mania returns, just like Santiment suggested.