Crypto Adoption in Africa Surged 1,200% in 2021, Chainalysis

Africa is the undisputed global champ in crypto adoption, with growth exceeding 1200% in the last year, enough for its countries to dethrone part of last year’s Top 10 of most crypto-friendly nations.

According to a review by Chainalysis, the 1200% increase in incoming cryptocurrency volume over the year is almost 50% higher than the global growth average. The rest of the world united registered an also mind blowing 880% increase in the same period.

Not only has Africa’s cryptocurrency market grown over 1200% by value received in the last year, but the region also has some of the highest grassroots adoption in the world, with Kenya, Nigeria, South Africa, and Tanzania all ranking in the top 20 of our Global Crypto Adoption Index.

Crypto Retailers Set The Trend in Africa

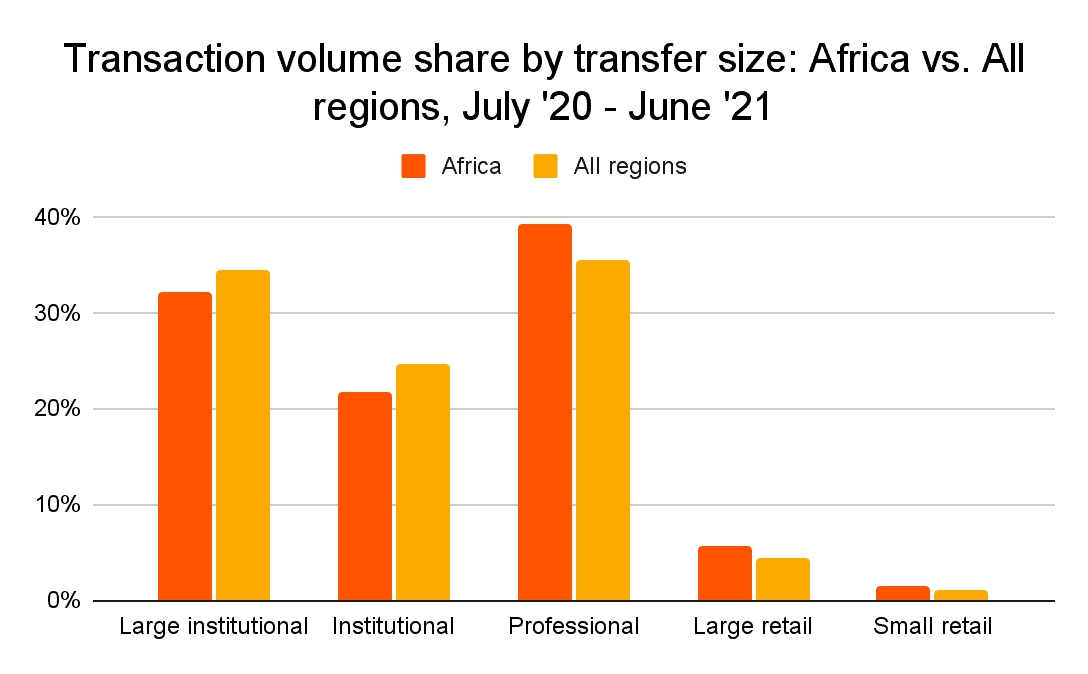

As Chainalysis reports, crypto adoption growth in Africa has been most substantial among retailers and non-institutional traders, which is in stark contrast to the landscape in developed countries where institutional investments are fundamental to the ecosystem.

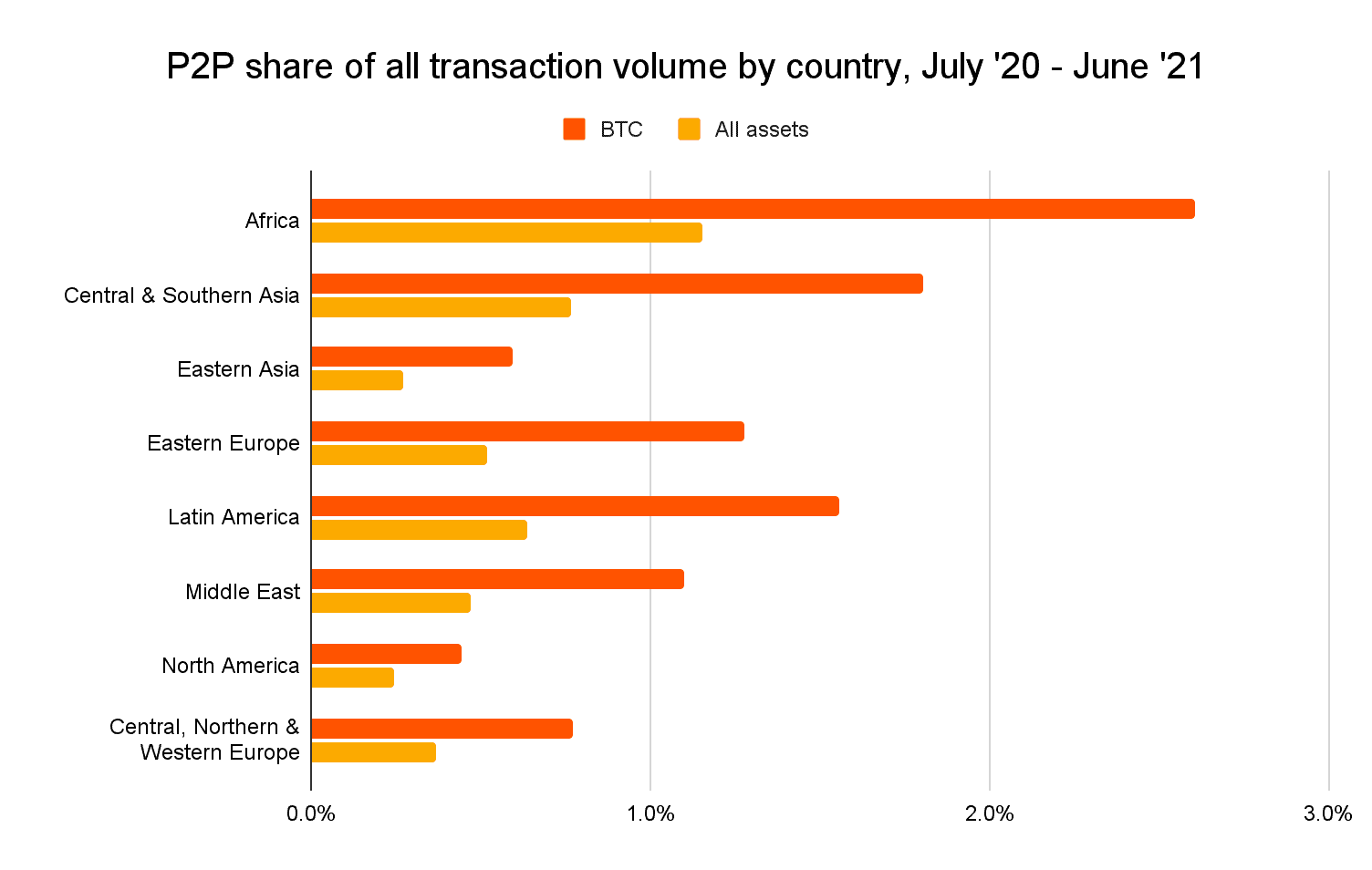

Another chart shows that Peer to Peer trading is extremely popular in Africa —way more than the rest of the world. As Cryptopotato previously reported, Chainalysis counts P2P trades as a major factor for cryptocurrency adoption, along with purchases, remittances and other financial interactions that use crypto as a means of exchange.

P2P trading has been instrumental in the explosion of cryptocurrency adoption in the country. According to data shared by Chainalysis and compiled by Useful Tulips, the growth of trading on LocalBitcoins and Paxful has skyrocketed since 2020. However, outside of traditional exchanges, there is a preference for more private and informal mechanisms such as Whatsapp and Telegram groups, so P2P trading volume is much higher in reality than what the compiled data shows.

Why do Africans Love Crypto?

Chainalysis explains that P2P platforms have started to steal market share from exchanges like Binance. According to Adedeji Owonibi, CEO and founder of the Nigerian blockchain consultancy company, Convexity, centralized exchanges like Binance are becoming less popular as Africans shift their preferences towards Paxful and other P2P sites.

Considering that the continent is dominated by the unbanked population, the use of P2P platforms has established itself as an easy way to move funds internally. However, the report says that almost 96% of crypto transfers in Africa are related to the remittance market.

Chainalysis argues that the use of Bitcoin and other cryptocurrencies has offset the high costs associated with international transfers.

Artur Schaback, Paxful COO, explained to Chainalysis that in addition to the costs, there are legal constraints that Africans can circumvent thanks to cryptocurrencies:

“If the government is strictly limiting the amount of money people can send abroad, they’ll get creative and turn to cryptocurrency. In many of these frontier markets, people can’t send money from their bank accounts to a centralized exchange, so they rely on P2P.”