Ethereum Fees Skyrocket on Marketwide Crash and NFT Minting E

The Fees on Ethereum’s network once again skyrocketed. This time, it seems to have been prompted by two separate causes – the marketwide collapse and an anticipated minting of a new NFT collection.

Ethereum Fees Highest Since May

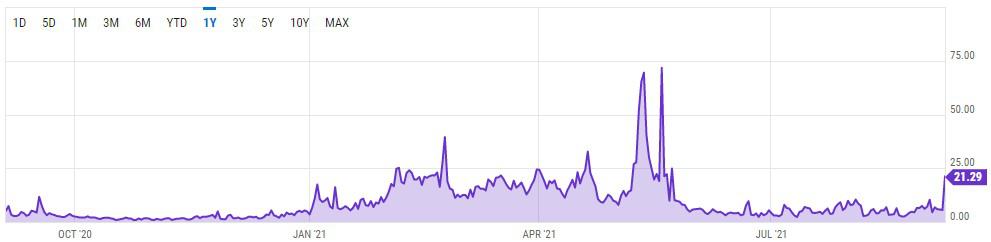

The fees on Ethereum’s network once again surged tremendously, charting an increase of about 300% in a day. Data from YCharts reveals that yesterday they were at the highest point since late May.

The average fees on Ethereum were recorded at $21.29 on September 7th.

The entire community took notice of this, with many arguing that there are competitive chains that provide a lot cheaper alternatives.

What Caused the Spike in ETH Fees?

There are two things that might be at the center of the high ETH fees. Right off the bat, and what seems like the more obvious explanation, was the marketwide collapse that we saw yesterday.

As CryptoPotato reported, over $2.5 billion worth of both long and short positions got wiped off in a matter of hours. This happened as Bitcoin tumbled below $43K, and Ethereum went almost as low as $3K.

An event of this kind triggers panic sellers. People flood exchanges, including decentralized ones like Uniswap, in an attempt to sell their holdings and prevent further losses. This, in turn, increases the requests for transactions and bid the ETH fees up. It happens every time there’s a sudden move in either direction.

There’s another event that took place yesterday which might also be a reason for the high fees. An NFT project called “The Sevens” had its presale ending on September 7th (yesterday). Many users reported that they had to pay tremendously high gas fees to process the transaction, while a lot of them also complained that they lost a lot in gas and the transaction failed anyways.