The Walmart-Litecoin Troll Could Face Major Criminal Charges

The fake news earlier this week that took Litecoin to the stars and back to the ground in a matter of hours could turn out to be more serious than it seems because —unlike what happens in the crypto-verse— the stock market is regulated to the millimeter.

According to information from Reuters, Walmart Inc launched an investigation regarding a piece of fake news that spread through news release distributor Globe Newswire claiming that the company had secured a partnership with the Litecoin Foundation to accept the cryptocurrency.

In addition, to Walmart Inc’s actions, Globe NewsWire said in an email that it would work with the appropriate authorities to investigate the case.

“We will work with the appropriate authorities to request – and facilitate – a full investigation, including into any criminal activity associated with this matter.”

Prison and Millionaire Fines

It’s very common in the world of Crypto Twitter to see prices move to the beat of rumors without further investigation. Such is the nature of the markets, and traders take advantage of this lack of regulation to orchestrate manipulation schemes that go from fake ads to massive coordinated Pump and Dump operations.

But when someone pulls a stunt like this to potentially impact the stock market, things change dramatically. And this is important because Walmart Inc is a publicly-traded company, and a potential partnership could influence the company’s fundamentals or risk.

On the surface, the “troll’s” actions were aimed at spiking LTC’s price, but it is possible to prove that, by extension, they may also have affected Walmart’s stock prices.

Under the Securities Act of 1933 and the Securities Exchange Act of 1934, a person is involved in securities fraud if willfully engages in deceptive practices intended to manipulate financial markets or induce investors to make financial investment decisions based on deceptive or false information. FindLaw defines securities fraud as follows:

Generally, securities fraud occurs when someone makes a false statement about a company or the value of its stock, and others make financial decisions based on the false information.

Third Party Misrepresentation is one kind of securities fraud, and it occurs when a third party gives out false information about the stock market or a particular company or industry. Convictions for federal securities fraud crimes can result in a 5-year federal prison sentence per offense and fines of up to $5 million.

The Litecoin-Walmart Fake Partnership

According to the official versions, a person posed as a Walmart staff member and passed the note to Globe Newswire for reproduction. After the news spread, Globe Newswire quickly published a statement to disregard the news release.

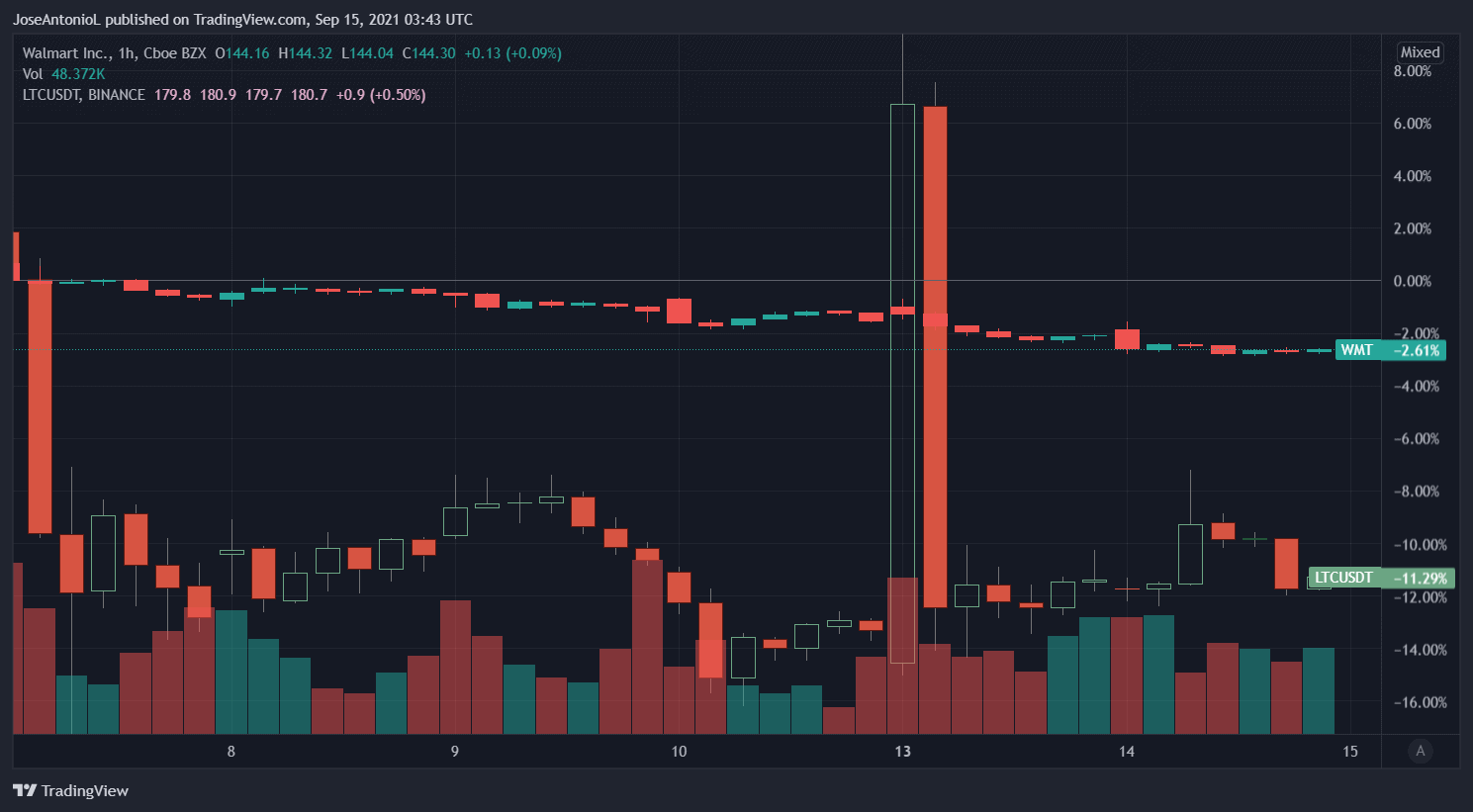

The news had little effect on Walmart’s stocks. However, Litecoin (LTC) abruptly spiked, only to crash with the same intensity. Someone made a lot of money with that move, causing significant damage to investors. Walmart’s stocks also went down a little bit. In the chart below, Litecoin (LTC) is represented with hollow candlesticks and Walmart (WMT) with traditional candlesticks.

So far, neither Walmart nor Global Newswire revealed which actions they would take; however, the masterstroke could be costly to whoever pulled it off —if caught.