What is Solana? Guide for Beginners

As innovative as it may be, blockchain technology faces particular challenges, including high fees, scalability issues, low throughput, and more.

Several projects in the DeFi space compete to become the first web-scalable blockchain and ensure that users have the best experience by tackling these common issues.

One of these, which is gaining traction in the DeFi community, is Solana. This open-source, censorship-resistant blockchain leverages a comprehensive set of technologies to amplify scalability and deliver a robust network for building decentralized applications (dApps).

What is Solana?

Solana is a decentralized protocol for building dApps with a reported throughput of 65,000 transactions per second (TPS) thanks to its distributed computing system.

Unlike most protocols that run with the Proof of Stake (PoS) or Proof of Work (PoW) mechanism, Solana uses the Proof of History (PoH) – a new cryptographic mechanism that amplifies scalability while maintaining network security.

Solana is among the few layer-one solutions capable of supporting thousands of transactions per second without having to implement second layers or off-chains.

Solana’s Key Technologies

Proof of History, a Cryptographic Clock

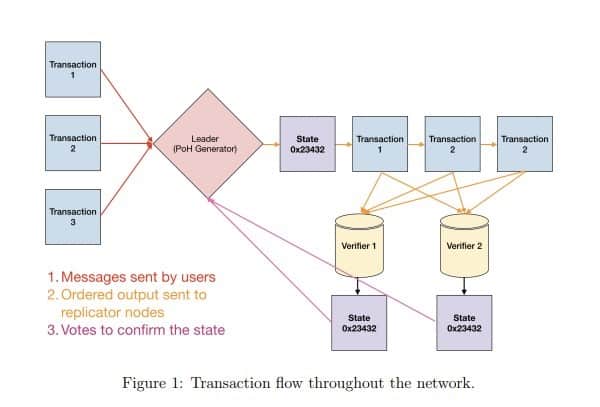

PoH is Solana’s consensus mechanism. It is a sequence of computations that provides a digital record to prove that an event occurred on the network at any given time.

Think about it as a cryptographic clock that gives a timestamp to every transaction in the network along with the data structure, which can be a simple append of data.

PoH relies on Proof of Stake, using the Tower BFT algorithm for consensus, which functions like an additional tool to verify transactions. At its core, PoH is a high-frequency Verifiable Delay Function (VDF).

A VDF is a triple function (Setup, Evaluation, Verification) to produce a unique and trustable output. It maintains order in the network by proving block producers have waited a sufficient amount of time so the network can move forward.

In Solana’s case, it uses SHA256 (Secure Hash Algorithm 256-bit) – a set of patented cryptographic functions that outputs a value 256 bits long (which is also the one Bitcoin uses). The Solana network periodically samples the count and hashes of the SHA256, providing real-time data instructed by the set of hashes included on CPUs.

Validators can use this sequence of hashes to record a specific piece of data created before a particular hash index is generated. The timestamp for transactions is generated once this piece of data is inserted.

Solana claims to reach a throughput of 65,000 TPS, with an average block time of 400 milliseconds and an average transaction fee of 0.000005 SOL (Solana’s native token). To achieve these numbers, all validators on the network have a cryptographic clock to keep track of events instead of waiting for other nodes to verify transactions.

Tower BFT

Tower BFT is an optimized version of the Practical Byzantine Fault Tolerance (PBFT) protocol that keeps the network secure and running. This mechanism is Solana’s underlying consensus that leverages the PoH cryptographic clock.

Tower BFT addresses certain problems like the cost of rollbacks, different ASIC speeds between nodes, or the risk associated with reward-based votes.

Turbine

Turbine is a block propagation protocol that leverages the network by breaking data down into packets distributed with a small amount of bandwidth, allowing nodes to perform better using less power.

Clusters

Clusters are groups of validators with different purposes, but their main task is to work together by serving client transactions. According to Solana, Clusters may coexist, and when two clusters share a common genesis block, they attempt to converge.

Gulf Stream

The Gulf Stream refers to Solana’s mempool-less forwarding protocol. A mempool is a cryptocurrency node’s mechanism for storing unconfirmed transactions before they are added to the blockchain.

Pipelining

Pipelining is a multiple transaction processing unit that creates different stages for every CPU to finish its task. This technique is commonly used in CPU design.

History and Foundation of Solana

Solana was founded in 2017 by Anatoly Yakovenko, a former engineer at multinational Qualcomm. He published the Solana Whitepaper that same year with the idea of creating a distributed system with a new algorithm that could build on and improve the predominantly used Proof of Stake and Proof of Work blockchains.

This is how Proof of History (PoH) was born, a timekeeping technique to encode the passage of time within the data structure.

The Solana ICO

Yakovenko joined his colleagues Greg Fitzgerald and Eric Williams to launch Solana, creating a prototype testnet a year later while also founding Solana Labs — based in San Francisco, California.

The project debuted via an Initial Coin Offering (ICO), raising over $25.6 million in March 2020. In June 2021, however, Solana Labs also raised $314 million for further development of the network.

Since then, it has become one of the fastest-growing protocols in the DeFi space. In 2021, the protocol caught the market’s attention not just because of its technology but also because of the impressive performance of its native SOL token, which exploded in value.

The Team Behind Solana

Apart from the founding members Yakovenko, Fitzgerald, and Williams, the project managed to onboard well-known developers and management personnel.

The team behind the Solana Foundation, a non-profit organization headquartered in Switzerland, promotes and works with international partners to support Solana. Solana Labs, on the other hand, takes care of the protocol’s development.

Solana Backers and Ecosystem

Solana’s debut attracted high-profile companies in the blockchain and DeFi space, as well as institutional capital, including Multicoin Capital, CMCC, Tether, Chainlink, Serum, and more.

Over 231 companies are currently included in Solana’s ecosystem, ranging from different industries. Some to mention are AMMs (Automated Market Makers – Serum), oracles (ChainLink, Gravity, Switchboard, Band Protocol, and Nozomi), stablecoin projects, Wallets, and exchanges.

The SOL Token

SOL is Solana’s native and utility token, used to stake and to pay for transaction fees. It is an inflationary token but designed with a decreasing supply and a 1.5% annual inflation rate.

SOL was launched in March 2020 amid the beta testnet release and has strived to become one of the leading cryptocurrencies.

As mentioned before, SOL has performed exceptionally well in 2021 and even became the 7th largest cryptocurrency by means of total market capitalization (as of September 2021).

As of writing these lines, roughly 18 months following the ICO, the SOL token’s price is 725x its ICO token price of $0.22

Solana’s Competitors

Solana has strived in the DeFi world to become a legitimate competitor of industry leaders such as Ethereum, Polkadot, and Binance (BSC).

We can compare them to see what benefits and downsides each one has.

Solana is supposedly capable of reaching a processing speed of over 60,000 TPS. This makes it one of the fastest blockchains to compete with other industries outside of the DeFi space.

Ethereum, for instance, can only handle 16 TPS. Solana has the advantage here:

- A different consensus algorithm to avoid slow transaction confirmation.

- A new tokenomics for lower fees.

- An overall better user experience.

However, Ethereum has been in the spotlight of the DeFi community as Ethereum 2.0 is being developed. ETH 2.0 is an upgrade that everyone in the DeFi community is expecting — it can highly improve scalability, lower fees, and increase the throughput.

An important feature that has attracted developers is Solana’s hybrid mechanism to solve typical blockchain issues, like PoH, which reduces the time between transactions and reinforces network security.

Here’s a key feature we need to understand about Solana that differentiates it from other blockchains: it’s non-linear, and its hybrid system and technology are impacting the DeFi substantially.

The Rise of NFTs on Solana

Solana has been booming in popularity in 2021, primarily because of the massive increase in its price. At the time of this writing, in October 2021, the cryptocurrency is up around 8000% in terms of YTD gains.

A lot of it came thanks to the explosive growth of non-fungible tokens on Solana’s blockchain. The reason why people preferred it over Ethereum was simple – it was cheaper and a lot quicker – users could mint NFTs at little to no cost, and there were hundreds of projects that took off.

Some of them, such as the Degenerate Ape Academy project, included NFTs that sold for over $1 million at the time. For example, one cryptocurrency venture capital fund, Moonrock Capital, acquired the 13th rarest ape for a whopping 5980 SOL, which at the time was worth $1.1 million.

The Downsides and Challenges of Solana

Yet Solana has inevitable setbacks it needs to tackle. While the protocol could compete against high-profile blockchain projects, it’s still vulnerable to centralization as there are not that many validators of the blockchain.

This is something that Solana has been criticized for: anyone on the network can become a validator, but doing so is challenging as it requires high computational resources.

This contributes to why the protocol still labels itself as a beta mainnet; specific bugs, codes, and delays could be present. Yet developers and projects are still coming to the network to build or be part of it, like Solstarter, Serum Swaw, or Raydium.

Along with that, the network had seen two major outages during the month of September. The second outage took hours to sort until enough network validators upgraded their version.

Conclusion

Despite its drawdowns, Solana is a high-performance blockchain that grabbed the attention of the community.

It has the backing of some of the best-known names in the industry and, despite some of its challenges, appears to be on the right track of growing.

In a short period of time, Solana became one of the most used platforms for various DeFi applications and was at the center of the NFT boom in 2021.